What Is Mechanical Breakdown Insurance?

What is Mechanical Breakdown Insurance (MBI), and how does it differ from a standard car insurance policy or warranty? MBI covers significant non-collision repair costs that warranties usually don’t, filling a crucial gap in your vehicle protection strategy. This article gives you an overview of what MBI entails, its limitations, and key considerations to help you determine if it’s the right coverage for your car.

Understanding What Is Mechanical Breakdown Insurance: Is It the Right Protection for Your Vehicle?

Mechanical Breakdown Insurance (MBI) offers comprehensive coverage for mechanical parts of your vehicle, beyond the standard car insurance policy and manufacturer’s warranty, also covering the labor costs for covered repairs.

MBI policies cast a wide net excluding routine maintenance and wear and tear, and in California, you’re allowed to choose any licensed repair shop for services. There are exclusionary policies which cover almost all vehicle parts except listed exclusions, and named component policies that cover only listed parts.

MBI costs are generally influenced by vehicle age, make, type of policy, and driving habits. It’s considered a cost-effective alternative to extended warranty plans, offering better coverage for a lower cost, and in California, MBI pricing and providers are regulated by the California Department of Insurance.

Deciphering Mechanical Breakdown Insurance

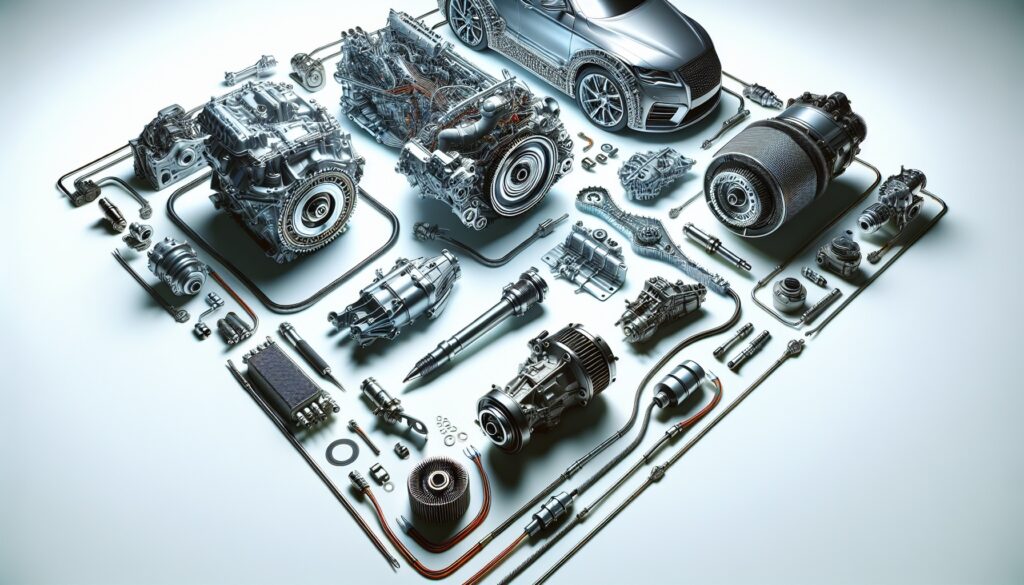

When your vehicle breaks down, it’s not just an inconvenience; it’s a financial burden. Mechanical Breakdown Insurance steps in like a knight in shining armor, offering a reprieve from costly repairs that are not related to accidents. MBI is a comprehensive form of coverage that caters to the mechanical aspects of your vehicle — from the engine’s deep roar to the air conditioning’s cool whisper. Unlike your standard car insurance policy, which typically covers damages caused by collisions or natural disasters, MBI focuses exclusively on the mechanical elements that keep your car running smoothly. It’s a specialized form of car repair insurance that stands distinct from the protections of an auto insurance policy, stretching its protective wings beyond the typical warranty horizon.

This coverage isn’t solely about the parts; it also values your peace of mind by covering the labor costs for covered repairs, ensuring that a mechanical fault doesn’t break your bank or your spirit. MBI is a testament to the adage ‘prevention is better than cure,’ setting up a safety net for when your vehicle’s internals decide to take an untimely break. What makes this coverage tick and what specific advantages does it confer? Let’s explore the intricacies of MBI plans.

The Basics of MBI Coverage

Mechanical breakdown insurance casts a wide net, offering comprehensive coverage that kicks in where your manufacturer’s warranty waves goodbye. It’s the financial assurance that major components, such as your car’s heart — the engine — or its complex nervous system — the transmission — will be taken care of without you having to shell out a significant sum for their revival. MBI policies are not a catch-all; they don’t cover routine maintenance services or the everyday wear and tear that comes with vehicle ownership. Think of MBI plans as the guardian of ‘big ticket’ items, the substantial repairs that can often catch you off guard and off budget.

What does an MBI policy truly offer under its ‘comprehensive coverage’ umbrella? It signifies a focus on the mechanical breakdowns that can immobilize your vehicle, leaving you stranded both physically and financially. While it won’t account for your regular oil changes or tire rotations, it stands ready to address the more profound, unexpected incidents that can disrupt your vehicle’s functionality — all without the restrictions of a factory warranty’s expiration date.

Choosing Your Repair Shop with MBI

The power to choose is invaluable, and Mechanical Breakdown Insurance upholds this by letting you decide where your vehicle gets serviced. Unlike some extended warranty plans that may dictate which repair facilities you can use, MBI plans tend to offer more flexibility, allowing you to choose any licensed repair shop that meets your standards. This means you can opt for the trusted mechanic down the street or the specialized repair shop that knows your car make inside out. Convenience and quality are at the forefront, ensuring that you’re not bound by a limited network of providers when it comes to getting your vehicle back on the road.

In California, this autonomy is especially pronounced. State regulations ensure that MBI policyholders have the right to select any licensed repair facility they prefer. Whether you’re dealing with transmission issues, mysterious engine noises, or tire troubles, you can take solace in knowing that you can turn to a mechanic you trust, backed by the financial support of your MBI coverage. It’s a level of independence that underscores the customer-centric nature of MBI plans, placing the power back in your hands.

MBI Policy Details: What’s Included and What’s Not?

One might question the details while exploring MBI coverage — what exactly does this insurance cover, and what falls outside its scope? An MBI policy is generous but not limitless; it extends its protective embrace to all mechanical parts of your vehicle, with a critical exclusion: maintenance services and items that bear the brunt of everyday use. This means that while it will come to the rescue for a sudden engine failure, it won’t cover the costs of car repairs related to new filters or spark plugs that have reached the end of their natural life cycle.

Moreover, there are certain scenarios where MBI will politely step aside. These include:

- Repairs resulting from intentional damage

- Corrosion due to poor maintenance

- Misuse

- Damages caused by accidents

These situations are beyond the scope of MBI.

California offers a unique take on MBI policies, with two distinct types: exclusionary policies, which cover the gamut of vehicle components except for those clearly excluded, and named component policies, which protect only the parts listed in the policy. It’s a tailored approach, providing options that allow you to choose the level of coverage that aligns with your vehicle’s needs and your peace of mind.

Cost Analysis: Mechanical Breakdown Insurance Worth and Pricing

The question of value often surfaces when considering any insurance policy, and mechanical breakdown insurance is no exception. Is the protection it offers worth the price of admission? The answer isn’t cut and dry; it’s a balancing act between the potential repair costs, the age and reliability of your vehicle, and the specifics of the coverage and deductible costs. Some may argue that the infrequency of mechanical breakdowns casts a shadow over the cost-effectiveness of MBI. Yet, for those who have experienced the financial shock of an unexpected repair, the worth of MBI is not up for debate.

When exploring the financial aspects of mechanical breakdown insurance, you might find the yearly mechanical breakdown insurance cost usually ranges from $30 to $75, a rate reflecting the policy’s adaptability to diverse needs and budgets. Over the span of six years, this translates to a total cost ranging from approximately $180 to $450 — a fraction of what a significant repair might demand from your wallet. In the grand calculation of risk versus reward, these numbers paint a picture of MBI as a potentially prudent investment in your vehicle’s longevity and your financial stability.

Factors Influencing MBI Costs

As with most insurance policies, several factors come into play when determining the cost of mechanical breakdown insurance. These factors include:

- The age of your vehicle

- The type of vehicle (luxury or high-end vehicles may have higher premium rates)

- The type of MBI policy you select

- The level of coverage you desire

- Your driving habits

These factors can steer the costs of mechanical breakdown insurance in different directions.

In California, the age and mileage of your car are particularly influential factors that insurance companies consider when pricing MBI. Additionally, the choice to add MBI as an endorsement to an existing auto insurance policy could be a more cost-effective route than pursuing a standalone MBI policy. With each company offering varying rates, the range of potential costs is as diverse as the vehicles they protect. It’s essential to review your options, consider the variables at play, and choose a plan that aligns with your financial and vehicular circumstances.

MBI vs. Extended Warranty Plans: Key Differences

When pitted against extended warranty plans, mechanical breakdown insurance often emerges as the more economical contender, boasting better coverage for a lower cost. But the battle of benefits doesn’t end at the price point. The median cost of an extended warranty hovers around $2,458, a significant leap from MBI’s average initial cost for a three-year plan. While both MBI and extended warranties aim to shield you from the financial impact of vehicle repairs, they diverge on aspects such as deductibles — MBI includes them, while extended warranties typically do not.

Extended warranties often come with perks like roadside assistance and rental car services, which may not be part of the MBI package. Furthermore, while extended warranties tend to enforce certain restrictions on repair locations, often requiring dealership services, MBI policies grant you the liberty to choose your repair shop, including independent providers. The eligibility criteria also differ; extended warranties are usually reserved for new or lightly used vehicles, whereas mechanical breakdown insurance is accessible for used cars with less than 15,000 miles. These distinctions are key in determining which type of protection aligns best with your vehicle’s age, your preferences for repair services, and your financial strategy.

How Does Mechanical Breakdown Insurance Work?

The operational mechanics of a mechanical breakdown insurance policy resemble the well-known process of an auto insurance policy. When a covered system in your car malfunctions, you initiate a claim, opening the gates to potential financial relief for necessary repairs. Companies that offer mechanical breakdown insurance ensure a smooth process, typically involving a direct line of communication between your insurer and the mechanic to authenticate the need for the repair and to ensure that the proposed fix aligns with the policy’s coverages.

Upon approval of the claim, the insurance company provides a payout for the repairs, with the final amount being adjusted by any deductible that applies. It’s a sequence designed to minimize disruptions to your life, ensuring that mechanical failures don’t translate to financial setbacks. With MBI, you’re investing in a promise — the promise that when the complex components of your vehicle falter, you won’t be left to face the financial repercussions alone.

California-Specific MBI Insights

In California, MBI is more than just a standard insurance product; it’s a regulated service designed to cater to the specific needs of its vehicles and drivers. The California Department of Insurance sets the stage for MBI, establishing a framework that guarantees standardized coverage and consumer protection — a testament to the state’s commitment to providing accurate and unbiased information to its consumers. It’s an approach that ensures MBI providers offer a level of service that is both fair and transparent, giving Californians peace of mind when investing in the protection of their vehicles.

The Californian twist on MBI includes coverage for major components like:

- the engine

- the transmission

- the electrical system

- other vital parts

This robust shield has been meticulously crafted to address the unique demands of California’s diverse driving conditions and the vehicles that navigate them, including your new car. This state-specific insight into MBI underscores its value as an investment in your vehicle’s health and your financial well-being.

Why California MBI Stands Out

California’s MBI policies are not just beneficial; they’re built with a distinct advantage. The oversight of the California Department of Insurance (CDI) ensures that MBI pricing is fair, reflecting a direct relationship between the insured risk and the cost, without tipping into excessiveness. This regulated pricing is complemented by the requirement that most vehicle service contracts must be backed by a CDI-approved backup insurance company, adding an extra layer of financial security for consumers.

The unique consumer protections embedded in California’s MBI policies further distinguish them from offerings in other states. These protections ensure that consumers have access to dependable coverage that’s consistent across the board, thanks to the Department of Insurance’s regulatory efforts. It’s a setup that serves to elevate the status of California MBI, positioning it as a leading example of how insurance can be tailored to meet the specific needs of a state’s residents, providing them with the assurance that their investment is sound and their vehicles are in safe hands.

Making the Most of California MBI

For Californians, mechanical breakdown insurance represents a ray of hope amidst the uncertainties of vehicle ownership. It’s particularly beneficial for those who have shifted gears from new to existing, or used cars, providing a financial buffer against the unpredictable costs of mechanical repairs. By choosing California’s MBI, used car owners can navigate the roads with confidence, knowing that the financial burden of an unexpected breakdown will be significantly reduced.

The benefits of California MBI are not just for the present; they’re an investment in the future. By mitigating the costs of repairs, MBI allows car owners to maintain their vehicles in top condition, potentially extending their lifespan and preserving their value. It’s a strategic move that can save money in the long run, proving that sometimes, paying a little upfront can prevent a much larger payout down the road.

Summary

As we cross the finish line of our exploration into Mechanical Breakdown Insurance, it’s clear that MBI offers a compelling case for vehicle owners. It stands as a specialized form of coverage that not only complements your auto insurance policy but also extends a helping hand when the unexpected mechanical breakdowns occur. The key takeaways are simple: MBI can provide comprehensive coverage for major vehicle components, it offers the freedom to choose your repair shop, and it can be a cost-effective solution when balanced against potential repair costs.

In California, MBI shines even brighter, with its regulated policies and unique consumer protections setting a gold standard for vehicle insurance. Whether you’re behind the wheel of a gleaming new car or a trusted used vehicle, MBI offers a layer of financial protection that can keep you rolling smoothly along life’s highways. As you consider the roads ahead, remember that MBI could be the assurance you need to drive with confidence, no matter what mechanical surprises may come your way.

Frequently Asked Questions

What is a mechanical breakdown in insurance?

A mechanical breakdown in insurance refers to coverage for unexpected mechanical failures of a vehicle that prevent it from operating properly, offering peace of mind and financial assistance for repairs (minus a deductible). This insurance is similar to an extended warranty, but is usually less expensive.

What does breakdown insurance cover?

Breakdown insurance covers damages caused by internal forces like power surges, electrical shorts, and mechanical breakdowns, providing financial assistance for repairs or replacement parts. It works similarly to a car warranty, reducing out-of-pocket costs for unexpected vehicle repairs.

How does mechanical breakdown work?

Mechanical breakdown insurance works similarly to other types of insurance, covering the cost of specific repairs for covered systems after paying a regular premium. It does not cover you after an accident but covers repairs for car parts that break down after a mechanical failure.

Can I choose my own repair shop with MBI?

Yes, with MBI, you have the freedom to choose any licensed repair facility to service your vehicle, providing you with the flexibility to select your preferred repair shop.

How cost-effective is mechanical breakdown insurance?

MBI’s cost-effectiveness varies based on factors like your car’s age, potential repair costs, and coverage level. Typically priced between $30 and $75 annually, it can be a smart investment for vehicle owners due to its potential to offset high repair expenses.