Extended Warranty For Used Cars

Deciding on an extended warranty for used car hinges on knowing what coverage suits your needs and how to spot a trustworthy provider. This guide offers concise, no-nonsense advice on evaluating extended warranty for used car options, understanding the costs involved, and finding a reliable warranty provider—equipping you with the knowledge to make an educated choice that balances protection with value.

Extended Warranty For Used Cars Overview

Extended warranties for used cars act as financial protection against repair costs after the original factory warranty expires, offering a range of coverage options from bumper-to-bumper to powertrain protection. The cost of an extended warranty is influenced by factors such as the car’s make, model, age, and mileage as well as the reliability of the warranty provider, with the option of third-party providers often presenting more competitive rates.

When considering an extended car warranty, it’s important to understand the coverage limits, deductible amounts, and additional benefits, and to be aware of potential pitfalls such as scams and overly costly plans.

Understanding Extended Warranties for Used Cars

The journey of car ownership is often punctuated by unexpected pit stops. When the manufacturer’s warm embrace of warranty coverage fades away, you’re left exposed to the whims of mechanical fate. This is where an extended car warranty steps in, providing a shield against unforeseen repair bills that can drain your funds faster than a leaky radiator. These vehicle service contracts act like a financial airbag, deploying to cover repairs and replacement of certain parts long after the original factory warranty has bowed out. So, what do extended car warranties cover? They offer protection for various components of your vehicle, just like a vehicle service contract, giving you peace of mind on the road.

For the astute used car owner, an extended warranty serves as a strategic safeguard. It’s particularly worth considering when your vehicle has crossed the warranty finish line and may have garnered a history of repair issues or is on the brink of needing future fixes. It’s a balance of risk and reward, where forking out for an extended warranty might just be the knight in shining armor saving your bank account from distress.

Types of Extended Warranties

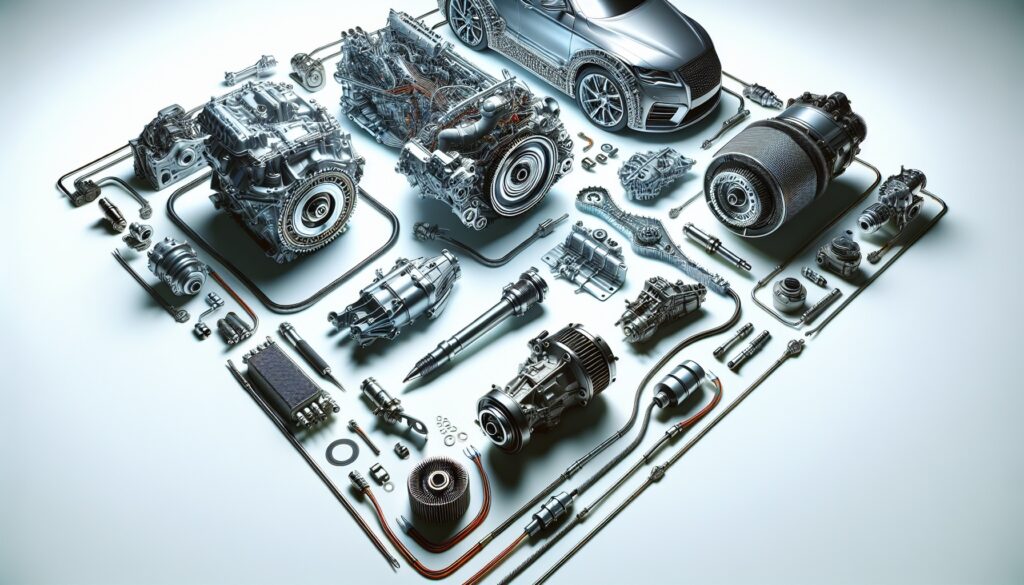

Exploring the realm of extended warranties is similar to choosing a path among a multitude of protection plans including Mechanical Breakdown Insurance. At one end, there’s the comprehensive canopy of bumper-to-bumper warranties, offering broad coverage that shelters most parts of your car, much like an umbrella during a cloudburst. On the other end, powertrain warranties stand guard, focusing on the heart and muscles of your vehicle – the engine, transmission, and drive systems – ensuring they keep pumping and propelling you forward.

For drivers who prefer a balanced approach, the Powertrain Plus Coverage might be your go-to option. This plan adds layers to the foundational powertrain warranty, roping in additional systems like your car’s suspension and brakes, and even the air conditioning that keeps you cool when the heat is on.

Then there are the stated-component warranties, selectively covering specific parts such as your electrical system or audio set-up to ensure your vehicle’s functionality.

Factors Affecting Warranty Cost

The price of an extended warranty is determined by various factors, including:

- Your car’s make and model, as they spell out the complexity and expected repair costs the warranty might need to cover

- The age of your car, with younger cars often attracting lower warranty costs

- The mileage on your car, with fewer miles often resulting in lower warranty costs

These factors collectively determine the final cost of the warranty. Younger cars with fewer miles on the odometer often attract lower warranty costs, while older cars with higher mileage demand higher premiums due to their propensity for breakdowns.

However, it’s not merely about the car; the reliability of the warranty provider is equally important. Warranty providers are the artisans behind the mosaic, each crafting their coverage options and pricing with a unique touch. This is where third-party warranty providers enter the stage, often offering competitive rates that can undercut the manufacturer’s offerings and add a twist to your decision-making.

Evaluating Used Car Warranty Providers

When evaluating used car warranty providers, consider it as an audition where you’re the judge. You want a provider that hits the high notes of reliability and customer satisfaction, with coverage options that perform a harmonious symphony of protection tailored to your needs. Top-rated companies like CARCHEX, autopom!, and Toco Warranty Corporation each bring their unique acts to the stage, offering an array of plans that range from the basic to the all-encompassing.

In this lineup, the best overall car warranty companies are:

- Endurance – known for its direct warranties and road service, with coverage plans scrutinized by actual mechanics.

- Toco Warranty Corporation – offers affordable plans and no down payment options, making extended warranties accessible even to those on a tight budget.

- CarShield – has demonstrated its financial reliability by paying out over 1 billion dollars in claims.

These companies have proven themselves to be reliable and trustworthy in the car warranty industry.

Reputation and Customer Reviews

A provider’s reputation either emphasizes their reliability or raises questions about their credibility. Online reviews serve as the audience’s applause (or lack thereof), giving you a front-row seat to past performances. These testimonials offer a glimpse into the provider’s responsiveness, claim handling, and overall tune they play when the curtains rise on your time of need.

The Better Business Bureau rating is like the industry’s critic review, a trusted barometer of a provider’s standing on stage. And when it comes to the encore – the claim payments – understanding the provider’s script is crucial. Will they require you to pay out of pocket initially, or will they settle the score directly? This can be the difference between a standing ovation and a walkout.

Coverage Options and Flexibility

The unique selling points of warranty providers lie in their coverage options and flexibility. Providers like CarShield and CARCHEX orchestrate a variety of plans, from the nimble seven-plan suite to a grand symphony of 21 coverage tiers. These options allow you to compose a warranty that resonates with your vehicle’s needs, whether it’s safeguarding major components like the engine and transmission or securing a discount to strike the right note with your finances.

While manufacturer warranties might serenade you with factory-trained technicians and easy cancellations, third-party warranties can dance to a different beat. They might offer more affordable rates and authorized shop repairs, striking a chord with those who value flexibility and choice. After the original concerto of the manufacturer’s warranty has concluded, these extended plans offer an encore for a fee, ensuring the show goes on.

Key Components of a Used Car Warranty

Understanding a used car warranty is akin to piecing together a puzzle; the key components must coalesce to present a comprehensive image of protection. These warranties don’t offer a blanket of coverage; rather, they have clear boundaries. By understanding the coverage limits, you’ll know whether you’re protected for the full journey or if you’re only covered for specific segments, like the engine, transmission, and drivetrain.

Deductibles are the pieces of the puzzle that directly affect the cost of any claims. They might be a fixed sum or a percentage of the repair cost, influencing the affordability of your repairs. And let’s not forget the additional benefits, those puzzle pieces that might seem small but can significantly enhance your warranty. Think roadside assistance for those unexpected flat tires or trip interruption coverage that steps in when you’re stranded far from home.

Coverage Limits

The coverage limits of a used car warranty draw the lines around what is and isn’t protected under your policy. It’s the map defining the terrain your warranty will cover, from the broad expanses of bumper-to-bumper coverage to the specific trails of powertrain protection. Some warranties even set a mileage limit, which can stretch up to 125,000 miles, but beware of depreciation clauses that might reduce your coverage as your car racks up the miles.

Knowing where you can seek refuge is also crucial. Extended warranties may require you to visit specific dealerships or service centers for repairs, so make sure your map includes these locations. And when it comes to the cost of repairs, it’s worth remembering that they often fall below the purchase price of the warranty itself, a consideration that might tip the scales when evaluating the value of your extended protection.

Deductibles

Deductibles in extended car warranties are the checkpoints you’ll encounter on your journey to a repaired vehicle. They represent the amount you’re willing to contribute to the cost of repairs, either as a single fee per warranty service visit or for each separate repair. With deductibles ranging from a modest $50 to several hundred dollars, they can steer the affordability of your warranty plan in one direction or another, impacting the overall extended car warranties cost.

Flexibility within warranty plans is like choosing your route on a road trip. Some plans offer options for deductibles, such as the choice between $300, $500, or even waived deductibles, giving you the freedom to select the path that best suits your budget and preferences. And if you service your car at a recommended facility, you might just find all deductibles waived, ensuring a smoother ride without financial bumps. Considering the car warranty cost is an important factor in making the right decision for your vehicle’s protection.

Additional Benefits

The additional benefits in extended warranties can be the cherry on top of your coverage sundae. Roadside assistance is like having a vigilant guardian angel who swoops in to help with flat tires, engine troubles, and other roadside emergencies. Rental car coverage, including rental car reimbursement, is another sweet perk, ensuring you stay mobile and aren’t left stranded while your primary vehicle is under the mechanic’s care.

Trip interruption coverage offers a cushion of comfort, providing for your lodging and food expenses if a breakdown disrupts your journey far from home. But before you indulge in these extras, be aware that providers may charge additional fees for these benefits, which could turn your sundae into a more expensive treat than anticipated.

When to Consider Purchasing an Extended Warranty for Your Used Car

Choosing to purchase an extended warranty for your used car is akin to determining the right moment to invest in quality hiking gear. You’ll want to consider it when your vehicle is starting to show its age or if the odometer suggests many adventures have already been had. This is when the likelihood of encountering repair trails increases, and having that warranty can be like having a trusty walking stick to help you along.

An extended warranty becomes even more valuable when the safety net of the original manufacturer’s warranty is about to disappear, or has already vanished into the rearview mirror. It’s also wise to consider how the vehicle is sold – with a warranty or “as is” – as indicated through the Buyers Guide, which can play a significant role in your extended warranty deliberations.

Ultimately, the choice between creating an emergency fund for unexpected repair costs or investing in an extended warranty can be a pivotal financial decision.

Negotiating and Comparing Extended Warranty Offers

Perfecting the art of negotiation and comparison with warranty offers mirrors the skills of a savvy shopper at a busy marketplace. You aim to haggle down to the most favorable price for the best coverage possible. Extended warranty prices may be flexible, swaying to the rhythm of negotiations, offering you a chance to snatch a discount or take advantage of promotions.

Delving into the fine print and comparing the array of offers is crucial to unearth the most suitable extended warranty for your vehicle. This is like comparing precious gems, where the true value doesn’t lie in the size or the sparkle but in the finer details and the confidence it brings.

Requesting Multiple Quotes

Gathering quotes from a variety of warranty providers is like collecting fruits from different orchards – you’re looking for the sweetest deal. This process ensures you’re not just picking the first apple off the tree but rather comparing flavors, textures, and prices to find the best fit for your palate.

When you’re requesting these quotes, understand your needs first. Contacting at least two sources, such as local dealerships, and asking for an itemized cost breakdown of the extended warranty will give you a transparent view of the market, helping you make an informed choice.

Evaluate each quote for differences in coverage and cost to ensure you’re getting the protection you need at a price that aligns with your budget.

Negotiating with Dealerships

When you step into the dealership, be prepared to engage in a dance of negotiation over the price of an extended warranty. Dealerships often mark up warranty prices from their wholesale cost, leaving room for you to pirouette towards a lower final price. Aim to strike a balance that allows for a fair profit margin for the dealer while also securing a deal that’s music to your ears – perhaps by offering to pay a reasonable amount over the dealer’s cost for the warranty.

To keep the dealers on their toes, request a detailed breakdown of costs. This ensures you’re not being led in a dizzying spin, especially when monthly payments are emphasized over the total cost. By comparing the warranties offered by the dealership, including both manufacturer’s and aftermarket options, with those from third-party providers, you may find a more harmonious arrangement that offers better pricing and coverage that’s tailored to your performance.

Common Pitfalls and Scams to Avoid

When exploring extended warranties, vigilance against scams and pitfalls is critical. These can come disguised as unsolicited calls or official-looking mail, playing a siren song of warranty renewals that are nothing but a mirage. Guard your personal and financial information like a treasure chest, never surrendering it to callers or mailers that pressure you with urgency or dangle ‘Final Notices’ as bait.

The fine print of a warranty is the map to buried treasure, revealing the true nature of what’s covered and what’s not. It’s here that you’ll find the X marking exclusions for wear and tear or damages from accidents, helping you avoid the pitfall of assuming coverage where there is none.

Remember, extended warranties are not always a golden ticket to financial savings, as they sometimes cost more than the treasure trove of repairs they cover, so weigh your options carefully to determine if there’s true value in the purchase or if it’s better to buy an extended warranty.

Maintenance Requirements and Warranty Coverage

Embarking on the journey with an extended warranty necessitates diligent maintenance. Like a captain maintaining their ship, you must adhere to the warranty’s maintenance requirements, such as following the manufacturer’s service schedule and performing routine tasks like oil changes and tire rotations, to ensure your coverage doesn’t run aground. Failure to keep up with these routine services can be like sailing into a storm without a compass – it can lead to your warranty being voided and your claims denied.

Warranty providers will often ask for a logbook of maintenance, with receipts or service records serving as your proof of responsible stewardship. Keeping this documentation in order is as crucial as charting your course correctly, guaranteeing that your warranty provides the support you expect when you need it most.

Summary

As we dock at the end of our journey through the intricacies of extended warranties for used cars, remember that these service contracts are more than just a piece of paper – they are a commitment to your vehicle’s longevity and your peace of mind. Whether you’re cruising in a reliable old sedan or a sprightly convertible, an extended warranty can be a wise investment that steers you clear of financial squalls. Evaluate the providers, understand the coverage, and consider the timing; and you’ll be ready to set sail with confidence, knowing that should rough seas arise, your warranty will be the anchor that holds you steady.

Frequently Asked Questions

What are two reasons not to buy an extended warranty?

Extended warranties might lead to dissatisfaction with repairs and the risk of the provider going out of business, and they often do not cover every possible repair needed, as well as restricting repair options. Consider these reasons before purchasing.

Who has best warranty on used cars?

Carchex is considered the best choice for a used car warranty, offering a wide range of plans and coverage options, including coverage for up to 250,000 miles. Other good options include CarShield, Endurance, Omega Auto Care, and Olive.

What is the difference between a powertrain and a bumper-to-bumper warranty?

A powertrain warranty covers essential propulsion components like the engine and transmission, while a bumper-to-bumper warranty provides broader coverage for almost all mechanical and electrical components, excluding routine maintenance and wear and tear items.

Can I negotiate the cost of an extended warranty?

Yes, you can negotiate the cost of an extended warranty, especially at dealerships. By comparing quotes and understanding the dealer’s cost, you can enter negotiations with an informed starting point.

Are extended warranties worth the cost for a used car?

Yes, extended warranties can be worth the cost for a used car, especially if the car is older or has high mileage, which increases the likelihood of costly repairs. However, it’s important to carefully review the coverage details, deductibles, and additional benefits to determine if it’s a financially beneficial choice for you.