Are Extended Car Warranties Worth It?

Is investing in an extended car warranty a financially sound decision? When the standard warranty term from your car’s manufacturer ends, the dilemma of whether to buy extended protection becomes prominent. This article aims to provide a clear perspective on the cost-benefit ratio of extended car warranties, helping you make an informed decision and answer the question, “are extended car warranties worth it?” without advocating a definitive answer.

What Is An Extended Car Warranty?

Extended car warranties, more accurately known as Vehicle Service Contracts, provide repair coverage after the manufacturer’s warranty expires but generally cover fewer parts and may exclude routine maintenance and wear and tear.

The cost of extended car warranties can vary widely (approximately $1,000 to $4,500) based on factors like coverage level, vehicle type, age, mileage, and whether the car is still under the original warranty.

While extended car warranties can offer peace of mind and protection against costly repairs, they may not be cost-effective for everyone, especially if the warranty goes unused or the repair costs are less than the warranty itself.

Understanding Extended Car Warranties

Often referred to as a Vehicle Service Contract (VSC), an extended car warranty is a plan that provides repair coverage beyond the expiry of the manufacturer’s warranty. The term ‘extended car warranty’ is somewhat of a misnomer, as it’s not actually a warranty but a service contract that you purchase. Once the manufacturer’s warranty, usually valid for a minimum of three years or 36,000 miles, expires, this contract comes into effect.

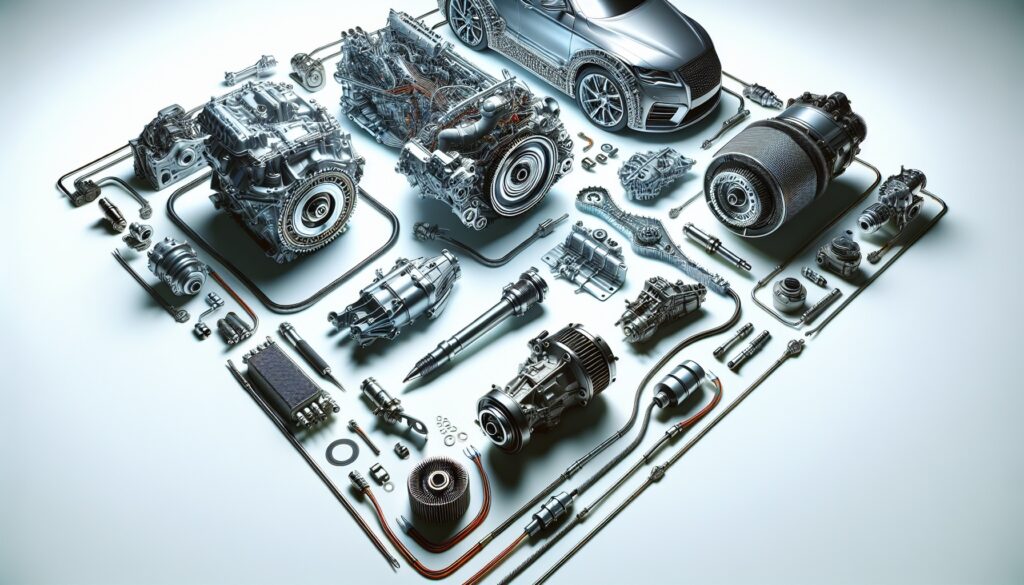

It’s designed to protect you from bearing the full cost of repairing or replacing key components like:

- the engine

- transmission

- gaskets

- axels

Once the manufacturer’s warranty is no longer valid, it’s essential to consider alternative options for product protection.

While manufacturer’s warranties are bundled with the vehicle at purchase, extended warranties are additional policies you buy from either dealerships, manufacturers, or third-party providers. They come with broader provisions and are not bounded by the same ‘full’ or ‘limited’ labeling or disclosure requirements as factory warranties. These warranties provide a protective layer against potentially costly repairs for the duration specified by the extended warranty.

The basics of a Vehicle Service Contract

A Vehicle Service Contract is an optional agreement that extends coverage beyond the standard manufacturer’s warranty for an additional charge. It is a contract between the vehicle owner and the VSC provider, detailing which repairs are covered and which are not. The main distinction between a VSC and a warranty is that the former is a promise to perform (or pay for) certain repairs or services, while the latter is a guarantee for a product to perform in a certain way over a specific period.

Contrary to popular belief, a VSC is not a warranty, even though it is often referred to as an ‘extended car warranty.’ This can be somewhat confusing, but it’s vital to understand the difference. A VSC becomes pertinent after the expiration of the manufacturer’s car warranty, providing a safety net for unexpected repair costs.

In essence, a VSC can ensure your vehicle remains in top condition even after the manufacturer’s warranty has run its course, offering protection and peace of mind.

Eligibility for coverage

Before the prospect of extended coverage sparks your interest, be aware that not all vehicles are eligible for a Vehicle Service Contract. The eligibility for an extended warranty is influenced by factors including:

- the presence of a current warranty

- the vehicle’s age

- mileage

- overall condition

For example, older or high-mileage vehicles may not be eligible for certain coverage plans.

When considering an extended warranty for a used car, understanding any remaining original warranty, its transferability, and how these might affect the additional warranty coverage is crucial. Interestingly, extended warranties, particularly those from third-party providers, can often be transferred when selling the vehicle, although a transfer fee may be required. This could potentially enhance the vehicle’s resale value, making it a more attractive proposition for potential buyers.

Coverage Details: What’s Included and Excluded

Naturally, you might be wondering what exactly an extended car warranty covers. These warranties often cover major vehicle systems such as heating/air, engine, and brakes, with terms and conditions varying from contract to contract. Nonetheless, it doesn’t provide universal coverage for all vehicle components. For instance, routine maintenance, wear and tear, oil and fluids, and tire services are typically not covered by extended warranties.

Exclusionary and inclusionary, or ‘listed component’ plans, are the two primary types of extended warranties. Exclusionary warranties are broader, implying coverage for most vehicle components except those explicitly listed as not covered. On the other hand, inclusionary plans specify exactly which parts are covered. Therefore, it’s crucial to thoroughly review the coverage details before signing on the dotted line, as extended warranties generally cover fewer parts compared to original manufacturer warranties.

Types of coverage

To further complicate matters, there are several types of extended warranty coverages available for vehicles including:

- Bumper-to-bumper warranty: Also known as an exclusionary warranty, it offers the most extensive coverage. It covers nearly all mechanical and electrical components of the vehicle. It mirrors the coverage of original factory warranties by covering most vehicle components while excluding a specific list of items.

- Powertrain warranty: This warranty covers the major components of the vehicle’s powertrain, including the engine, transmission, and drivetrain.

- Corrosion warranty: This warranty covers the vehicle against rust and corrosion.

On the other hand, there are different types of warranties that you should be aware of:

- Basic warranties cover the entire vehicle for a certain period of time or mileage, typically 3 years or 36,000 miles.

- Powertrain warranties cover essential vehicle parts such as the engine, transmission, and drivetrain, with the cost depending on the provider and terms of the coverage.

- Corrosion warranties focus on damage caused by rust and corrosion to the vehicle but do not include routine maintenance issues or general wear and tear.

Understanding these types of coverage, including rental car coverage, can help you choose the one that best suits your vehicle’s needs and your financial comfort zone.

Common exclusions

Getting into the specifics, extended car warranties typically do not cover routine maintenance such as oil changes and tire replacement, or wear-and-tear items. Furthermore, vehicles that are used for commercial purposes or have been modified are often excluded from extended warranty coverage. Even bumper-to-bumper warranties may not cover certain items like tires or brake pads.

Similarly, damages caused by environmental factors or the vehicle’s commercial use are typically not covered under extended car warranties. Some warranties, called exclusionary warranties, list components that are explicitly not covered, which are similar to comprehensive plans. In contrast, named-component coverage only includes specific listed parts. Knowing these common exclusions can save you from unpleasant surprises down the road and help you make a more informed decision.

Costs and Factors Influencing Extended Car Warranty Pricing

Having discussed the nature and coverage of extended car warranties, we can now delve into their cost. The average extended car warranty cost is approximately $2,550, ranging from $1,000 to $4,500, varying based on the plan. However, these costs can fluctuate even more depending on the manufacturer. For instance, the cost for extended warranty on a Volkswagen can range from $1,500 to $3,500 whereas Mercedes-Benz warranties can range anywhere from $2,280 to $8,300. As such, understanding the various factors influencing the cost is crucial to make sure you’re getting the best value for your money.

The cost of an extended car warranty is influenced by several factors, such as:

- The extent and level of coverage

- The deductible amount

- The vehicle’s make, model, age, and mileage

- Whether it is still under the original new car warranty

These elements can all contribute to the overall price of the warranty. Additionally, high-end luxury vehicles are typically more costly to cover due to the expensive nature of repairs, while common cars like most four-door sedans tend to have more affordable warranty costs due to lower repair costs.

Older or higher-mileage vehicles are generally more expensive to cover with an extended warranty due to a greater likelihood of needing repairs. Even the deductible choice affects the cost of an extended car warranty, where a higher deductible results in a lower premium.

Average cost of extended car warranties

Delving further into the financial aspect, the cost of extended car warranties typically falls within the $1,000 to $4,000 range. Over the years, the average cost of extended warranties has been on the rise, now averaging around $2,500. However, the cost of extended warranties may not be justifiable for consumers who do not use the warranty, especially if the vehicle in question is used, has high mileage, or is already reliable.

This makes it all the more important to evaluate the potential repair costs against the cost of the extended warranty and assess whether it’s a worthwhile investment.

Factors affecting cost

What factors could cause the price of an extended warranty to fluctuate? Here are some factors to consider:

- The age and mileage of the vehicle: The cost of extended warranties increases for older, high-mileage vehicles compared to newer vehicles.

- Coverage levels and warranty periods: More comprehensive coverage levels and longer warranty periods lead to higher costs for extended car warranties.

- Deductible choice: The deductible choice also plays a role. Higher deductibles can reduce the upfront cost of an extended warranty, but they may increase out-of-pocket expenses during repairs.

These factors can all contribute to the fluctuation in the price of an extended warranty.

Another factor to consider is that extended warranty prices may be negotiable, and factors like dealership commissions and waiting periods can influence the actual terms. Therefore, it’s important to do your homework, understand these factors, and negotiate for the best price possible.

Pros and Cons of Extended Car Warranties

Choosing to invest in an extended car warranty, like any financial decision, has its pros and cons. On the plus side, extended car warranties can cover significant repair costs, such as engine or transmission issues, that could otherwise be financially draining. Having an extended warranty can also provide peace of mind to vehicle owners, knowing that they have a safety net for unexpected repair costs.

However, the flip side is that many consumers may not utilize their extended warranty, leading to a feeling of having wasted money. In fact, according to a survey, only one-quarter of participants expressed that they would opt to buy an extended warranty again. Repair costs for those who used their extended warranty were often less than the price of the warranty itself. Therefore, it’s crucial to weigh these pros and cons before deciding on purchasing an extended warranty plan.

Benefits of extended car warranties

Extended car warranties provide additional coverage that takes effect after the original manufacturer’s warranty expires. This is particularly helpful for vehicles known for reliability concerns. By protecting you from the full expense of major repairs such as transmission or engine failures that could amount to thousands of dollars, vehicle owners with extended warranties can experience significant cost savings. So, is an extended car warranty worth considering? It depends on your specific situation and the type of vehicle you own.

Besides the financial aspect, extended warranties also offer:

- Peace of mind through financial protection against unforeseen and costly repairs

- The ability to manage expenses with a predictable deductible

- Longer-term financial planning by deferring the need for immediate purchase of a new vehicle

- A safety blanket, knowing that you’re protected from potential financial surprises down the road.

Drawbacks of extended car warranties

While the benefits sound appealing, it’s important to bear in mind the potential drawbacks of extended warranties. Here are some potential drawbacks to consider:

- They do not cover regular maintenance or wear-and-tear damage.

- A lack of regular maintenance can even void warranty coverage, leading to potential unanticipated out-of-pocket expenses.

- The claims process for extended warranties can be complex and time-consuming, possibly leading to inconvenience and potential delays.

Another potential pitfall is overpaying for an extended warranty. This can happen if the car owner overestimates the need for repairs or if the warranty purchase is redundant due to an existing manufacturer’s warranty. Therefore, it is crucial for car owners to consider their vehicle’s reliability and their ability to afford major repairs without an extended warranty, which could influence the decision on whether to purchase the warranty.

When to Consider an Extended Car Warranty

So, when is the right time to consider an extended car warranty? If you plan to keep your car for a duration longer than the factory warranty, purchasing an extended warranty could be a good move. However, the potential cost savings on repairs should be weighed against the cost of the extended warranty to evaluate whether your financial situation and risk tolerance justify the extra expense.

In addition, if you have a unique car model or a strong relationship with your dealership’s service center, purchasing an extended warranty through the manufacturer may be advisable. Extended warranties can also be particularly valuable for used cars that are no longer covered by any warranty and have a history of needing repairs.

Used cars and Certified Pre-Owned vehicles

The dynamics of extended warranties shift slightly for used cars and certified pre-owned (CPO) vehicles. Buying a certified pre-owned vehicle from a new car dealership includes a factory warranty, which can be a simpler and potentially more economical choice than buying a non-CPO used vehicle and negotiating an extended warranty separately. Certified pre-owned vehicles typically come with low mileage, an accident-free history, and meet manufacturer and dealership standards, offering a more seamless extension of warranty coverage.

For non-certified used cars, an extended factory warranty can often be purchased assuming the vehicle is neither too old nor has excessive mileage on it. Furthermore, extended warranties are generally transferable when the car is sold, which can enhance the vehicle’s resale value and make it a more attractive option for potential buyers.

New cars with expiring manufacturer’s warranties

For new cars, the scenario is slightly different. To maintain continuous coverage and avoid any gaps in warranty protection, acquiring an extended warranty prior to the expiry of the manufacturer’s or dealer’s original warranty is often advised. This means, if you intend to keep your new car for a longer term than the coverage period of the factory warranty, which is typically at least three years or 36,000 miles, you should consider investing in an extended warranty.

This way, you can ensure that your new car remains shielded from unexpected car repair costs even after the manufacturer’s warranty expires.

Tips for Choosing the Right Extended Car Warranty

At this point, you should have a solid understanding of extended car warranties, their coverage, advantages and disadvantages, and the right time to contemplate them. But how do you choose the right one? Before purchasing an extended warranty, consider the overall expense and whether the cost aligns with the value, including the planned duration of car ownership and the types of repairs covered. Also, check for any additional perks included in the extended warranty, like trip interruption coverage or towing, that could enhance its value.

Flexibility is essential when selecting an extended warranty. Opt for a warranty that offers flexibility in selecting where your car can be repaired, thereby avoiding restrictions to specific networks of mechanics or dealerships. Moreover, it’s important to ensure that the warranty is suitable for your driving habits, particularly in terms of the mileage you expect to cover each year.

The ease of making a claim, either online or by phone, along with the usual payout time, are also worth considering when evaluating a warranty provider’s claims process.

Comparing providers

In terms of provider selection, keep in mind that dealership extended car warranties typically cost more than those from third-party providers. However, third-party companies might not match the service or reliability of manufacturer’s warranties, possibly leading to claims and coverage issues. Therefore, consider comprehensive coverage, flexible payment options, and excellent customer service as indicators of a provider’s quality.

Furthermore, when comparing warranty providers, it is important to consider the following factors:

- The company’s track record in handling claims

- Their standing in the industry

- The provider’s financial stability

- Reputation

- Flexibility in choosing repair locations

Providers associated with reputable automaker brands suggest credibility and a level of established trust, often including roadside assistance as part of their services.

Lastly, customer reviews on third-party sites like the BBB and Trustpilot can offer insights into real customer experiences.

Negotiating costs

Unless you are at the dealership, the price of an extended warranties are typically fixed. If a third party company is willing to negotiate the price, it is often a red flag. The cost of an extended warranty can be negotiated, which includes:

- inquiring about special discounts

- promotions

- loyalty rewards

- flexible payment plans

- being cautious of hidden fees

It’s also important to be aware of high-pressure sales tactics at dealerships or third party providers. This can lead to impulsive decisions that may not be in your best financial interest. Therefore, don’t rush the decision. Shop around to compare prices and coverage details from various providers to ensure you secure the best possible deal on an extended car warranty.

Summary

To wrap up, extended car warranties can provide a safety net against unexpected car repair costs, offering peace of mind. However, choosing the right one requires a thorough understanding of what they cover, their costs, and eligibility criteria. The decision to purchase an extended warranty is highly personal, depending on factors like your car’s age, your financial situation, and your tolerance for risk. So, weigh the pros and cons, do your research, compare providers, and negotiate costs to ensure you get the best bang for your buck.

Frequently Asked Questions

Is it worth getting an extended car warranty?

Yes, it’s worth getting an extended car warranty if you plan to keep your vehicle for a long time or have a used car with high mileage or a history of reliability issues. It can save you from costly out-of-pocket repairs in the future.

What are two reasons not to buy an extended warranty?

Extended warranties may lead to dissatisfactory repairs and prolonged service time, with a risk of the warranty provider going out of business. It’s important to weigh the potential repair costs against the benefits of the warranty.

Is the car warranty ever a good idea?

Yes, for a used car or a vehicle with high mileage, an extended warranty can be a good idea to protect against potential costly repairs and provide peace of mind. It’s especially beneficial if the car is known for reliability issues.

What is an extended car warranty?

An extended car warranty, also known as a Vehicle Service Contract, offers repair coverage beyond the manufacturer’s warranty, providing additional protection for your vehicle.

What does an extended car warranty cover?

An extended car warranty typically covers major vehicle systems like heating/air, engine, and brakes, but the details differ between contracts.